Stablecoin company Plasma is building a new blockchain that offers zero-fee USDt transactions.

Stablecoin company Plasma has raised $24 million to develop a new blockchain for Tether’s USDt, the world’s most popular stablecoin.

According to a Feb. 13 Fortune report, the funding round was led by venture firm Framework Ventures with participation from Bitfinex, Peter Thiel and Tether CEO Paolo Ardoino.

Plasma co-founder Paul Faecks told Fortune that the new blockchain will be built on the Bitcoin network and will attract users by offering zero-fee USDt

transactions.

Although USDt is already available on several blockchains, Plasma is focused specifically on stablecoin trading, which means it will be able to process and settle transactions quickly.

Although users won’t be charged for stablecoin transactions, service providers interacting with Plasma, like Curve and Aave, will be charged, Faecks said.

Representatives at Bitfinex and Tether did not immediately respond to Cointelegraph’s request for comment.

Tether has been increasingly focused on crosschain settlements and interoperability, having recently integrated with LayerZero to connect The Open Network (TON) with USDt’s broader ecosystem.

Tether also selected Arbitrum to provide the infrastructure layer for USDT0, its crosschain US dollar stablecoin.

Stablecoin market heats up

Tether’s USDt remains the largest stablecoin by market capitalization, but its dominance is slowly waning as Circle’s USD Coin

reestablished itself as a major competitor. USDC’s circulating supply recently surpassed $56 billion, having more than doubled from the bear market low in November 2023.

Elsewhere, the Global Dollar Network consortium, which includes Kraken, Paxos and Robinhood, is supporting the adoption of Paxos’ USDG stablecoin, which was launched in November.

Other competitors are also entering the mix, with digital asset exchange Crypto.com planning to launch its own stablecoin this year.

Stablecoin payment networks are also proliferating, with former Binance.US CEO Brian Shroder launching 1Money, a layer-1 platform supporting multicurrency stablecoins.

Stablecoins are proliferating at a time when regulators are increasingly recognizing the asset class’ legitimacy.

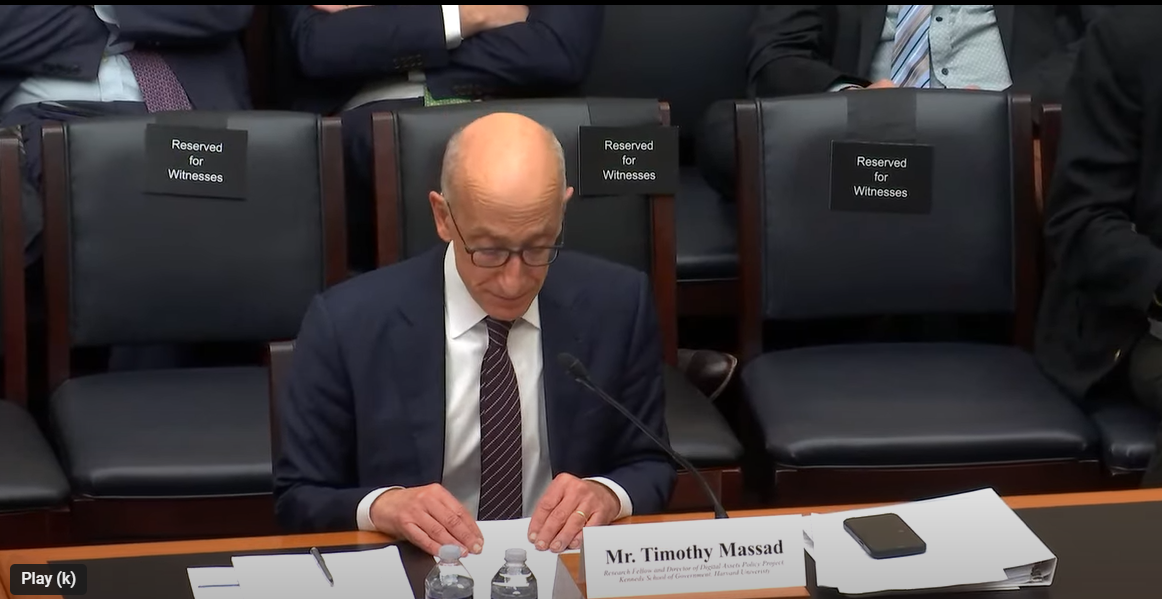

In the United States, former Commodity Futures Trading Commission Chair Timothy Massad called stablecoins “the most useful application of [blockchain] technology to date.”

Massad currently serves as director of the Digital Asset Policy Project at Harvard University.