During the 18th and 19th centuries, trade tariffs funded up to 90% of the United States federal government’s annual budget.

US President Donald Trump said he would announce a decision regarding reciprocal tariffs on import goods from trading partners on Feb. 13.

“Three great weeks, perhaps the best ever, but today is the big one: reciprocal tariffs!!! Make America Great Again,” the president wrote on Truth Social.

Previous news of import tariffs and a looming trade war sent crypto and stock markets plummeting as countries like Canada, Mexico and China considered counter-tariffs as a response.

Market analysts continue to debate the effects of President Trump’s trade tariffs on the crypto markets, Bitcoin

and the broader US economy.

Trump tariffs and the potential effects on markets

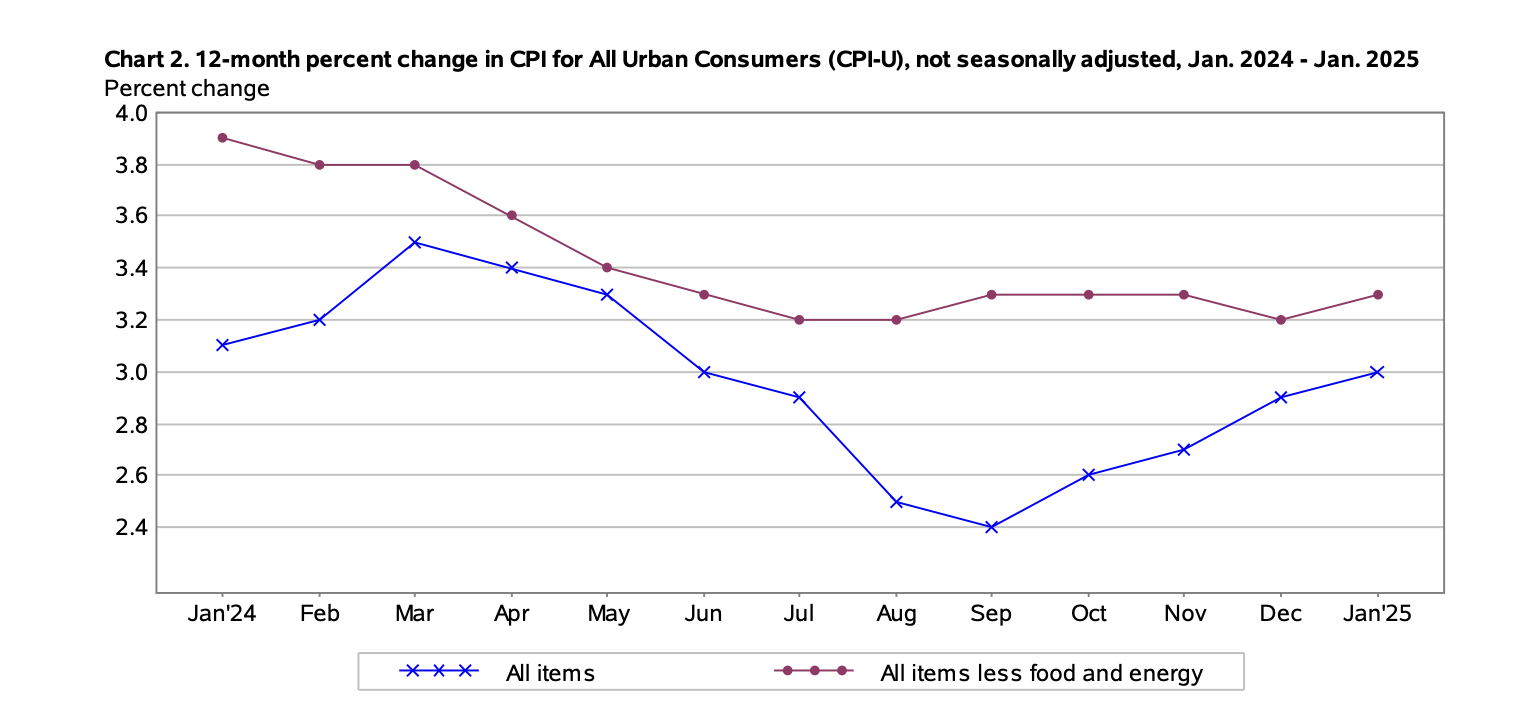

Tariffs have the potential to drive consumer prices higher, increase inflation and create volatility in financial markets.

The Feb. 12 US Consumer Price Index (CPI) data came in 0.1% higher than expected, with inflation hitting 3% — and Bitcoin dropping below $95,000 on the news.